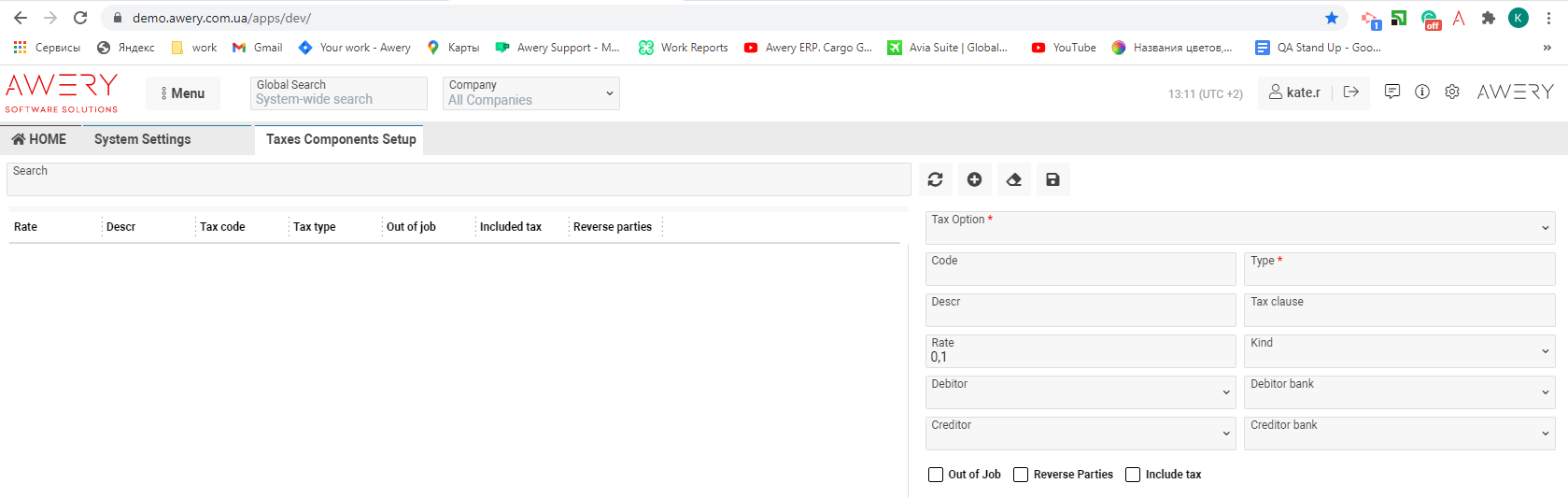

Taxes Components Setup

Home Page→ Settings→ System Settings→ Accounts→ Taxes Components Setup

Overview

Allows to create and edit Taxes Components Setup for Jobs

List description:

- Rate - number of tax rate

- Descr - description of tax

- Tax code - number of tax code

- Tax type - name of tax type

- Out of Job - shows which taxes selected as ‘out of job’

- Included tax - shows which taxes selected as ‘Included tax’

- Reverse Parties - shows which taxes selected as ‘Reverse Parties’

Manuals

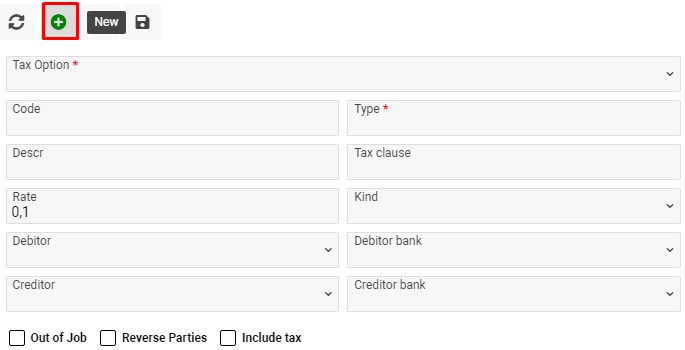

How to create Tax Component setup

- Select the tax option in the Tax Option selector to which you want to create the Tax Component Setup, if you opened the list 'Taxes Components Setup' for the first time.

Or press on the ‘+’ button, if you started switching between records. Then the form to create the Tax Component setup will be empty.

- The Kind field - the list of the kinds of category Kind of Transactions

- The Debitor and Creditor fields - the list of companies in the system

(Home > Offices/Companies)

- The Debitor bank and Creditor bank fields - the list of company banks in the system

( Home > Banks/Cash Setup)

- Check-box Out of Job - the amount of the tax does not fall into the total of the job, that is, it immediately creates an out of job transaction.

- Check-box Reverse Parties - when creating a tax transaction, changes the debitor and his bank in places with the creditor.

- Check-box Include tax - by default, all taxes are excluded, that is, they are added to the total amount of the job, and if the tax is included, by this checkbox, then the amount of the tax will be in the total amount of the job.

- Press on the Save button to save your entry after completing the form

Where you can use it:

Taxes Components Setup you can use for Jobs.