UAE VAT Support and Reporting

Awery support the VAT processing as per UAE Federal Tax Authority requirements.

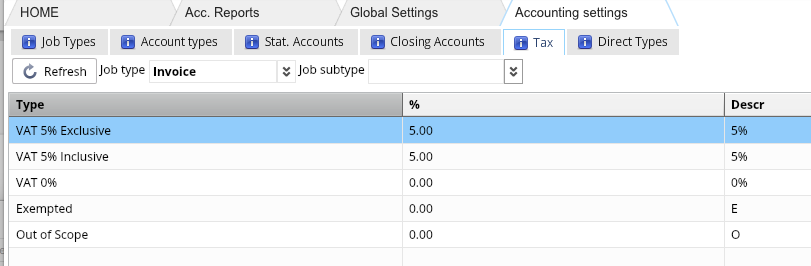

Setup of VAT shall be done as per Tax setup process:

https://help.awery.com/manual/awery-erp/accounting-and-finance/accounting-settings/tax-settings

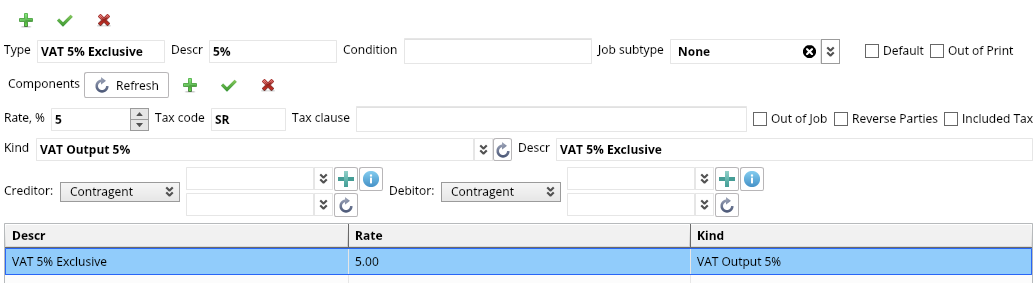

VAT Components shall have the TAX code set up (Max 2 Characters):

Sales Invoices and Credit Notes:

| VAT type | % | Tax Code | Description |

|---|---|---|---|

| Standard Rated | 5 | SR | Local supply of goods and services |

Supplies subject to reverse charge | 5 | RC | Import of goods and services by registered recipient |

Zero rated | 0 | ZR | Supplies involving goods for export or provision of exported services |

Exempt | NA | EX | Specific categories of supply are exempt from VAT. |

Intra GCC | NA | IG | Supplies of goods and services to registered customers in other GCC implementing states |

Amendments to output tax | NA | OA | Any amendments or corrections due to Output tax errors from a previous VAT return and where the tax amount of correction is not more than 10,000 AED. |

Purchase Invoices and Debit Notes:

| VAT type | % | Tax Code | Description |

|---|---|---|---|

| Standard Rated | 5 | SR | Purchases from VAT registered suppliers that are subject to VAT at 5% |

Supplies subject to reverse charge | 5 | RC | Import of goods and services by registered recipient |

Zero rated | 0 | ZR | Supplies involving goods for import or provision of imported services |

Amendments to output tax | NA | IA | Any amendments or corrections due to Input tax errors from a previous VAT return and where the tax amount of correction is not more than 10,000 AED. |

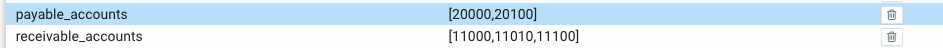

Two global settings parameters shall be set for the reports to work:

https://help.awery.com/manual/awery-erp/system-settings/global-configuration-settings

receivable_accounts - Comma separated list of Receivable Accounts from Chart of Accounts

payable_accounts - Comma separated list of Payable Accounts from Chart of Accounts

TaxCodeNoSelection - Global to link all transaction with no TAX selection to the Zero rated TAX in reports

Sample:

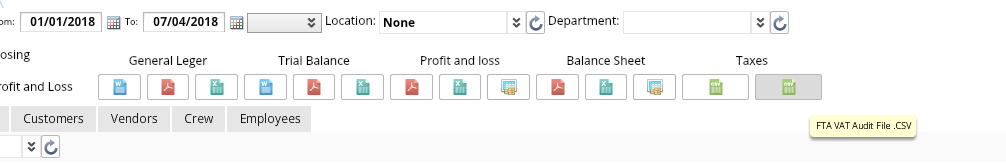

VAT Reports:

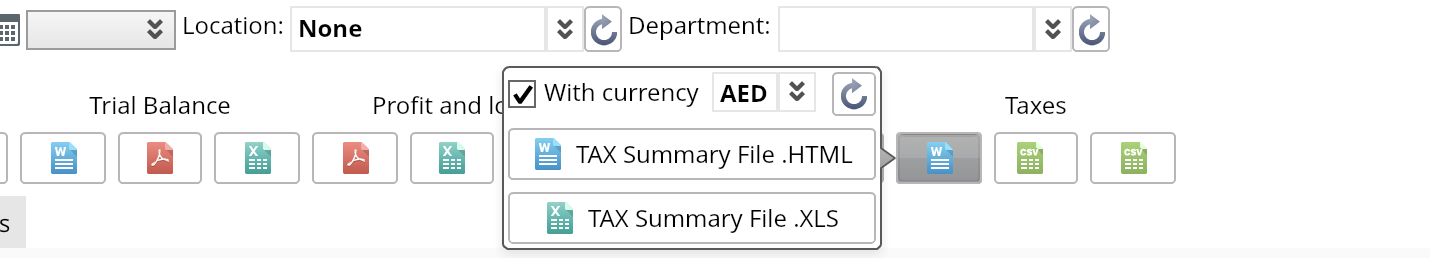

VAT Detailed

Can be converted to Required Currency, if not selected Default company currency will be used.

- Tax will be segregated by TAX code as separate TAB in Excel File.

- Sorting is done based on the job type and job Date.

Fields:

| Date | Doc no | Ref no | Job id | Job type | Job subtype | Name | Country | State | Desription | Rate | Sale Value | Purchase Value | Tax Collected | Tax Paid | Original Currency | Original Value | Original Tax |

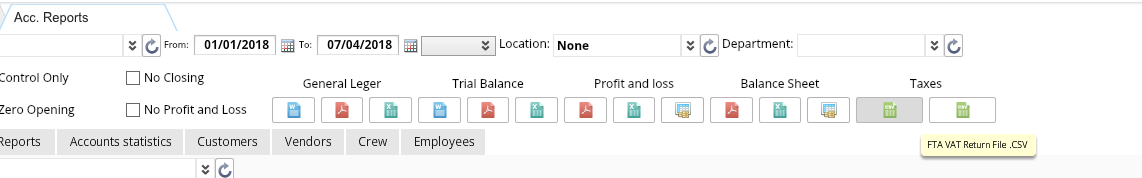

VAT Return

Menu - Accounting Reports - FTA VAT Return File

Selected company and dates will filter the report results

FTA VAT Audit File (FAF)

Menu - Accounting Reports - FTA VAT Return File

Selected company and dates will filter the report results