Taxes Options Setup

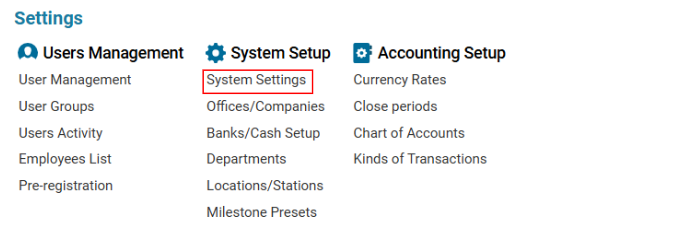

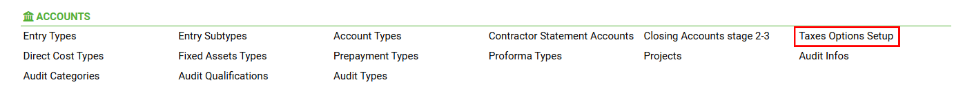

Accessing Taxes Options Setup

Navigate to the Settings section and under the System Setup Section click the “System Settings” Button. Then under the Accounts Section click the “Taxes Options Setup" button.

Overview

The Taxes Options Setup module allows users to create and edit taxes applied to Jobs. It also supports filtering taxes based on Job Type and Job Subtype.

Main Functionalities

List Description

Total Percent: The percentage value of the tax.

Type: The category/type of the tax.

Descr: A brief description of the tax.

Out of Print: Indicates whether the tax should not appear on printed documents.

Default: Identifies the default tax applied automatically when creating a job.

Condition: The conditions under which the tax is applied.

Deleted: Identifies taxes that have been removed.

How to Create a Tax Option

Open the Taxes Options Setup list for the first time.

Click the ‘+’ button if switching between records.

Fill in the required fields:

Total Percent

Type and Description

Office Selector: Displays a list of registered companies (Settings > Offices/Companies).

Job Type Selector: Displays a list of job types (Entry Types).

Job Subtype Selector: Displays a list of job subtypes (Entry Subtypes).

Check the ‘Out of Print’ box if the tax should not appear on printed job documents.

Check the ‘Default’ box if this tax should be applied automatically in job creation.

Click Save to store the tax entry.

How to Delete a Tax Option

Select the tax entry to be deleted.

Click the Delete button.

Sorting and Filtering Options

You can filter and sort taxes by:

Job Type

Job Subtype

Where You Can Use Tax Options

Applying Taxes to Jobs:

When selecting a job type, only relevant taxes will appear in the Tax Selector.

Default taxes will automatically be applied unless changed manually.