TAX Settings

Features:

- Tax Options Management

- Tax Option Selection on JOB level

- Tax Option Selection on Transactions level

- Multiple TAX options/components for complex and compound Taxes

Auto Calculation of Tax based on transaction amount

Option for calculation:

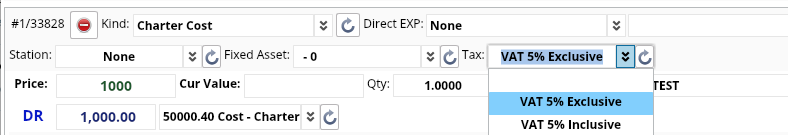

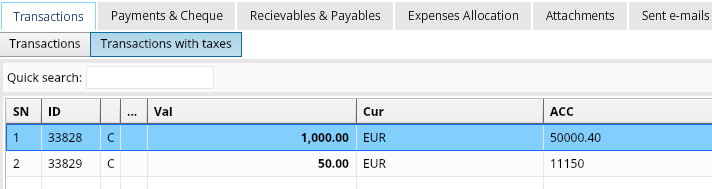

Added TAX: System will add based on % in tax options settings to the transaction amount.

Example added TAX: VAT 5%, transaction amount is 100 USD, system will add additional TAX transaction of 5 USD

Included TAX: TAX Inclusive amount - System will recalculate the transaction amount and split it on amount with no TAX (will update the encoded transaction amount) and add TAX transaction based on %.

Example included TAX: VAT 5%, transaction amount is 100 USD, system will change the transaction amount on save to 95.24 and add TAX transaction of 4.76 USD

- Option to include or exclude the TAX amount in Job total amount

TAX Setup Process:

(Based on UAE VAT setup of 5%, the other is done the same flow)

I. Add Tax Accounts in Chart of Accounts

- VAT Payable - Current Liabilities, type -

- VAT Receivable - Current Assets, type -

- VAT Expenses - Expense account, type +

II. Add Kind of Transactions for TAX entries:

Invoice:

Name: VAT Payable

Debit Account: Accounts Receivable (11000 in standard COA)

Credit Account: VAT Payable

Description: VAT Payable

Purchase Invoice:

Name: VAT Receivable

Debit Account: VAT Receivable

Credit Account: Accounts Payable (20000 in standard COA)

Description: VAT Receivable

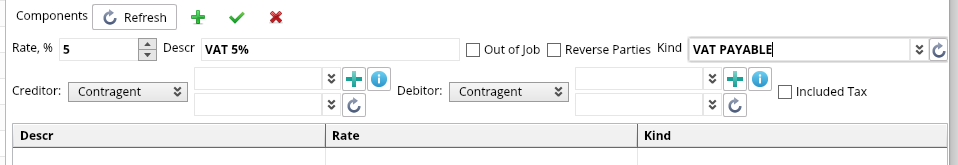

III. Setup a TAX options for Invoices and Purchase invoices

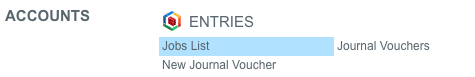

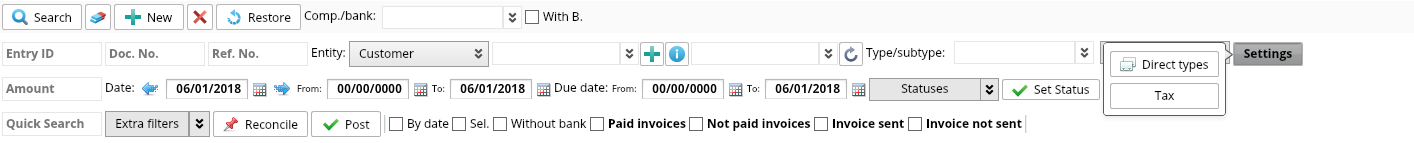

In JOBs list - select settings:

Add TAX Option:

Select the Job type

Click New (plus icon)

Enter the TAX Name and Description

Select Sub-type - if custom TAX settigns required for specific Jobs Sub-types

Default tick - will be auto-selected for such Job Types and Sub-types on Invocie Creation Window

Click Save (green tick) to add the TAX

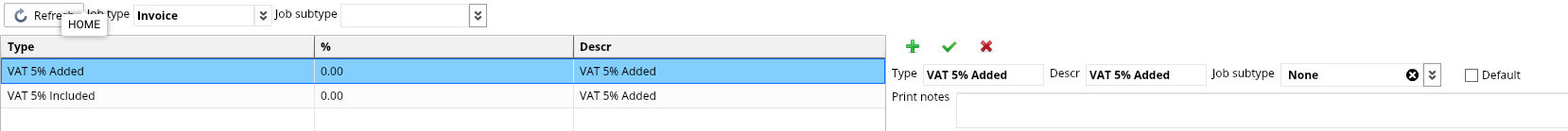

TAX Component:

After adding TAX Option - select the Tax Option on left Table and add the Tax Components:

Click New (Plus Icon)

Input rate in percent (0% is alos acceptable)

Input Decription (Nature of TAX component) - will be shown in Transaction descrition

Select Kind of transaction applicable to this TAX component

Optinal selection:

Out of job - will not all to Job total in the Jobs list

Reverse Parties - reverce Debitor and Creditor in TAX Transaction

Forct the Debitor and Creditor selection based on the TAX Option

Included TAX - to recalculate the transaction amount as it was entered including the TAX rate

How to Use

In any accounting job:

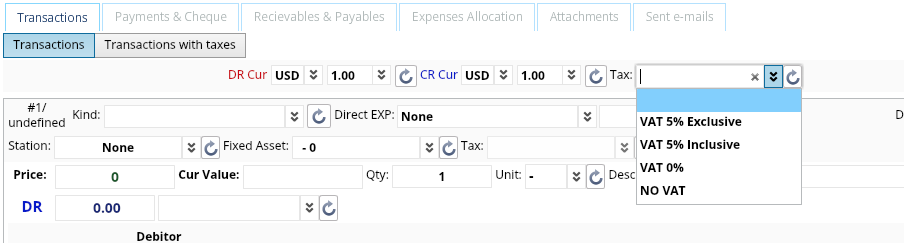

Selection of TAX is avaliable for all transaction - next to the currency rates selection

Or Transaction level:

View th TAX Transaction - select in Transaction list - Transactions with Taxes:

On Invoice Creation:

Select the TAX Option Applciable