New Fixed Asset

New Fixed Asset

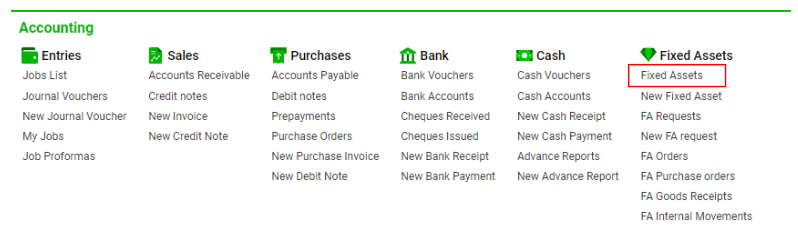

Navigate to Fixed Asset:

Navigate to the Accounting section and under Fixed Assets click the “Fixed Assets” button.

The elements of the interior interface include:

The Fas Data tab

The Special Documents tab

The Fas Documents tab

The Jobs tab

The Statements tab

The Orders tab

Note that all tabs except the Fas Data tad will be hidden until the entry is saved

The Fas Data tab

Main Information Block

Main Type, Find by Name selectors

Purchase on full price, Purchase on loan radio buttons

Additional Block

Type, Subtype, Status, Company, Department, Location, Incoming Account, Depr. Account, Expc. Account, Employee, Currency, and Rate selectors

Name, Serial Number, Model, Asset Description, Serial No, Invoice No, Registration No, LPO No, Engine No, Asset Cost, Other Cost, Total Cost, Opening Depr, Opening Net Value, Booked Asset Value, Booked Accumulated Depreciation, Booked Net Value, Lifetime, Notes input fields

Very bad, bad, normal, good, excellent condition checkboxes

Start Date, Purchase Date, and Close Date calendars

Gen No and Add new type buttons

Manuals:

How to create a New Fixed Asset

Select the type of purchase - full price or loan.

Pick any supplier from the list. If you have a new supplier - create it in the suppliers' module.

Fill in information about the item and purchase for outside and inner purposes: Name, model, Registration No, etc.

Pick the type/subtype of FAS from the list.

Input purchase info - LPO and Invoice No.

Put the asset and additional/other costs, opening depreciation value. Total cost and opening net value will be counted by the system.

You can also link FAS to a department and employee and set the location for reports and inventory.

Select the company to put the FAS on the company balance.

Select the right accounts according to your company policy and presets. These settings will affect the accounting operations with FASes.

Set the lifetime of FAS in months and set the dates - this input will be used by the system to accumulate the depreciation starting from the (first date of running / exploitation of the item), which is mandatory to set.

Informational Panel:

Remaining lifetime: Months till the end of FAS lifetime.

Depreciation per month: Amount accumulated per month.

Estimated depreciation: Amount accumulated since the starting date.

Estimated Net value: Net value up to date.

How to add a new type:

Click the + button to add a new type.

Fill in the necessary fields and click the Save button. The new type will be shown in the Type selector.

In case you need to create a subtype, click the New button in the footer of the sidebar. The new subtype will be shown in the Subtype selector.

How to create a Serial Number:

Click the Gen No button to generate the unique serial number automatically.

Additional opportunities:

You have an opportunity to create income job.

Create Income Job: Click the "Create income job" button to generate a new job with the FAS Income type.

Ensure that the supplier is selected; otherwise, an error message will appear if the "Find by Name" field is empty.

Sale/Disposal Job: Click the "Sale/Disposal Job" button to open the sidebar.

Fill in the necessary fields according to your requirements, and click the "Proceed" button to recalculate the balance amount.

Then, click the "Create Job" button to generate a new job with the FAS Disposal type. You can also click the "Open Orders" button to see the list of all linked orders.

The Fas Documents Tab

Input Fields:

Name: The name of the document.

No: The number of the document.

Type: The type of the document.

Notes: Additional notes regarding the document.

Issued by: The authority that issued the document.

Issue country selector: Dropdown to select the country that issued the document.

Issue date calendar: Calendar to select the date of issue.

Expire date calendar: Calendar to select the expiration date.

Expired checkbox: Mark if the document is expired.

N/A checkbox: Mark if the document is not applicable.

List Description:

Name: Displays the name of the document.

No: Displays the number of the document.

Type: Displays the type of the document.

Issued By: Displays the issuing authority.

Is. Count.: Displays the issuing country.

Issued: Displays the date of issue.

Expires: Displays the expiration date.

Valid: Shows if the document is valid (tick for valid , cross for expired ).

Actions:

You have the opportunity to Create, Delete, Clone, or Edit Fas documents.

The Special Documents Tab

Input Fields:

Name: The name of the document.

No: The number of the document.

Type: The type of the document.

Value: The value of the document.

Issued by: The authority that issued the document.

Notes: Additional notes regarding the document.

FAS: Input field for linking to FAS.

Issued country selector: Dropdown to select the country that issued the document.

Customer Type: Dropdown to select the type of customer.

Customer: Dropdown to select the customer.

Office: Dropdown to select the office.

Aircraft: Dropdown to select the aircraft.

Access type: Dropdown to select the access type.

Issue date calendar: Calendar to select the date of issue.

Expire date calendar: Calendar to select the expiration date.

Expired checkbox: Mark if the document is expired.

N/A checkbox: Mark if the document is not applicable.

List Description:

Name: Displays the name of the document.

No: Displays the number of the document.

Type: Displays the type of the document.

Issued By: Displays the issuing authority.

Is. Count.: Displays the issuing country.

Issued: Displays the date of issue.

Expires: Displays the expiration date.

Valid: Shows if the document is valid (tick for valid , cross for expired ).

Left: Shows the number of days between the current date and the expiration date.

N/A: Displays if the document is not active.

Color Indicators:

Violet background: More than 1 day difference.

Red background: Up to 7 days left before expiration.

Orange background: Up to 30 days left before expiration.

Yellow background: Up to 60 days left before expiration.

Green background: Up to 90 days left before expiration.

F (clip icon): Indicates the presence of attachments.

Actions:

Create, Delete, Clone, or Edit Special documents.

The Jobs Tab

Displays a list of jobs that match the customer's type and name.

The Statements Tab

Displays a list of statements that match the customer's type and name.

The Orders Tab

Displays a list of orders that match the name of the fixed asset.

Important Note

Fixed Asset Close Date: The date on which the depreciation is posted is used to determine when the fixed asset is closed by depreciation. If it is beyond the current closing period, the depreciation processing will be ignored.

No Posted Debit Balance: If there is no posted debit balance on the closing date, the fixed asset will not be processed for depreciation.