Fixed Asset Depreciation closing

Fixed asset depreciation is created with the closing of the accounting periods.

Step 1.

Create Request for closing for the required period (by month/quarter/year)

Step 2.

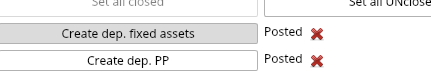

Click the Create Depreciation Fixed Assets button to create the deprecation accounting entry

The depreciation of Fixed Asset Entry is created based on values in its profile, please be sure all the mentioned conditions are met before creating the Fixed Assets depreciation creation in closing periods:

- Current posted debit amount in Fixed asset more that the current depreciation amount

- Company of closing is the same as in Fixed Asset

- Fixed Assets accumulated depreciation closing date is less then the date of current closing period

- The income, depreciated, expenses account

- The remaining lifetime is less than the closing period

Please note that if the Fixed Asset is depreciated in the period after than current closing (in case the depreciation entry was created by that closing of period) or any of mentioned conditions are not met - the depreciation for that Fixed Assets will be not created.